abstract.

Currently, countries have two clear options when looking to anchor exchange rates to curtail macroeconomic instability: either anchoring exchange rates to the US Dollar, or anchoring exchange rates to the Euro. In either scenario, the model of exchange rate choice by Alesina and Barro posits these currencies act as imperfect solutions. The US and the European Union produce different goods and services and thus have completely different economies than the developing countries that currently anchor their exchange rates, which leads to differing monetary policy needs—policy that is controlled by the anchor country. Using a panel data set spanning 64 years of monetary policy and 179 countries, I predict the benefit to prospective anchored exchange rate regimes. In this paper, I look at the implications of the rise of the Chinese, Indian, and South Korean economies as a previously unnamed outside choice for exchange rate anchors. I also assess whether capital increases as a result of joining a fixed exchange rate regime. Examining co-movements between prices and outputs, I find that the countries that would benefit the most from anchoring exchange rates to China or India are countries from Eastern Europe: the Czech Republic, Slovakia, Croatia, and perhaps Macedonia. Currently no countries may benefit from anchoring exchange rates to South Korea. Additionally, I find that fixed exchange rate regimes cause a significant increase in capital inside a client country.

Download it here.

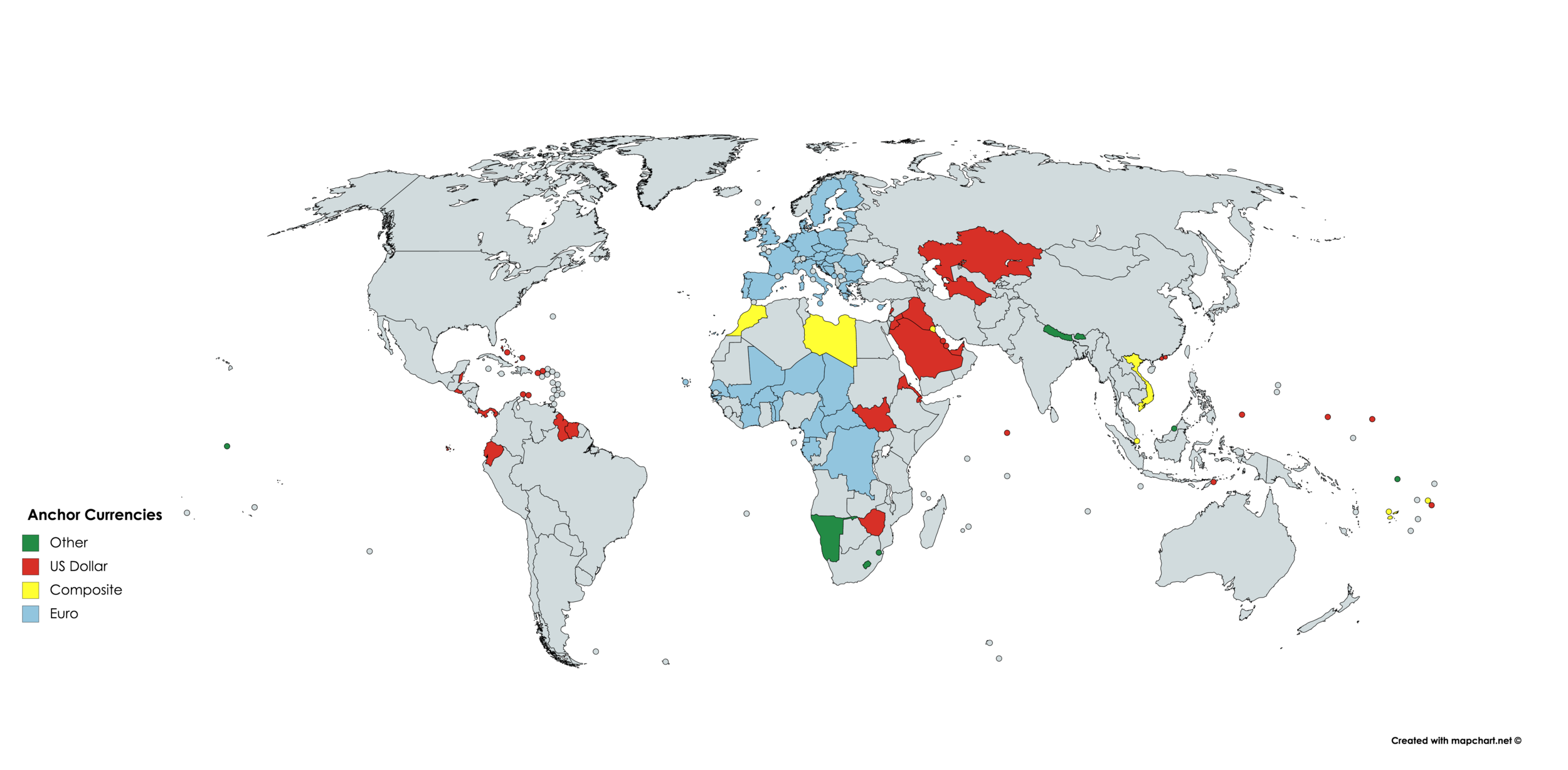

All the countries in the world currently in or in recently history in a fixed exchange rate regime.